The De-Dollarization Debate: Navigating the Future of Global Currency

- Westbank Financials

- Mar 18

- 2 min read

Introduction

A potential de-dollarization in the global macroeconomy has been steadily approaching.

Following World War 2, the US became and has remained the primary global reserve currency. However, this position has declined since. The IMF states that the dollar’s share of currency reserves was at 70% in 2001 and 59% in 2023.

Political Factors

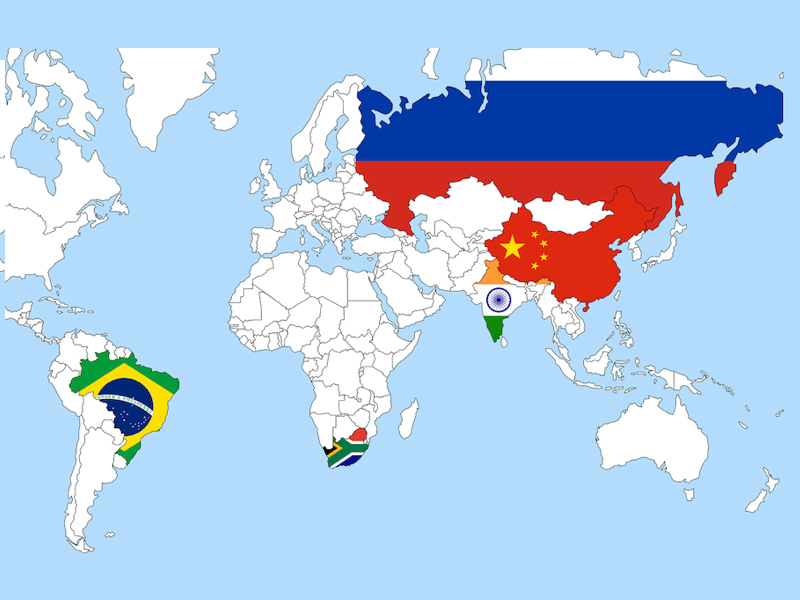

In the midst of a geopolitical power struggle, numerous countries are aiming to accelerate the de-dollarization process. One reason is because the dollar is becoming increasingly weaponized as a foreign policy tool. Countries that are tied up in the US dollar and face US economic sanctions face tremendous economic difficulties. For example, BRICS, a group of powerful and emerging economies with 45% of the world’s population, have considered creating their own replacement currency. Following the Russian invasion into Ukraine, the US’s economic sanctions have also raised questions about the stability of the currency.

Economic Factors

From an economic perspective, significant capital could be reallocated away from US markets if complete de-dollarization occurs. The Federal Reserve has some say in the direction of dollarization. Increasing the interest rate typically increases the value of at-home currency (the US dollar) because it attracts foreign direct investment, thereby causing the exchange rate to rise. Decreasing the interest rate does the opposite, as we’ve seen with the Fed’s recent half a percentage point decrease in the interest rate. Separately, the US could lose significant economic flexibility and imported goods could increase in price.

An Alternative Future

However, as the US dollar weakens, no clear alternative is paving the way for replacement. The Euro has depreciated relative to the dollar and the Yen has weakened significantly. China’s crashing property market and macroeconomy does not suggest that the Ren Min Bi is ready for primetime. BRICS countries are increasing their scope as Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates have joined in 2024. Despite this, the US dollar remains the dominant currency and will likely exert its influence over the short term.

Conclusion

Just as the US dollar replaced the British sterling as the global reserve currency in the 1920s, others are aiming to do the same in the 2020s. Only time will tell what truly happens.

Comments